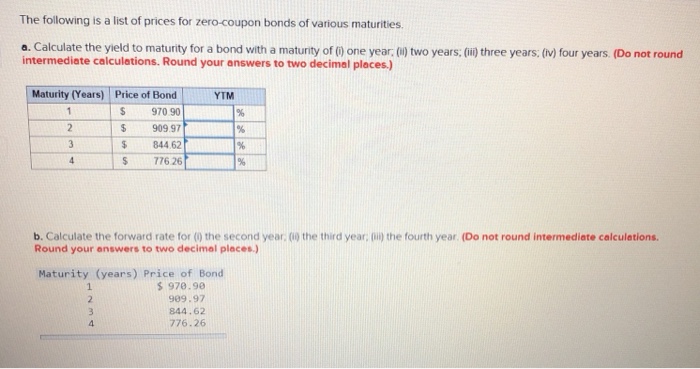

43 yield to maturity for zero coupon bond

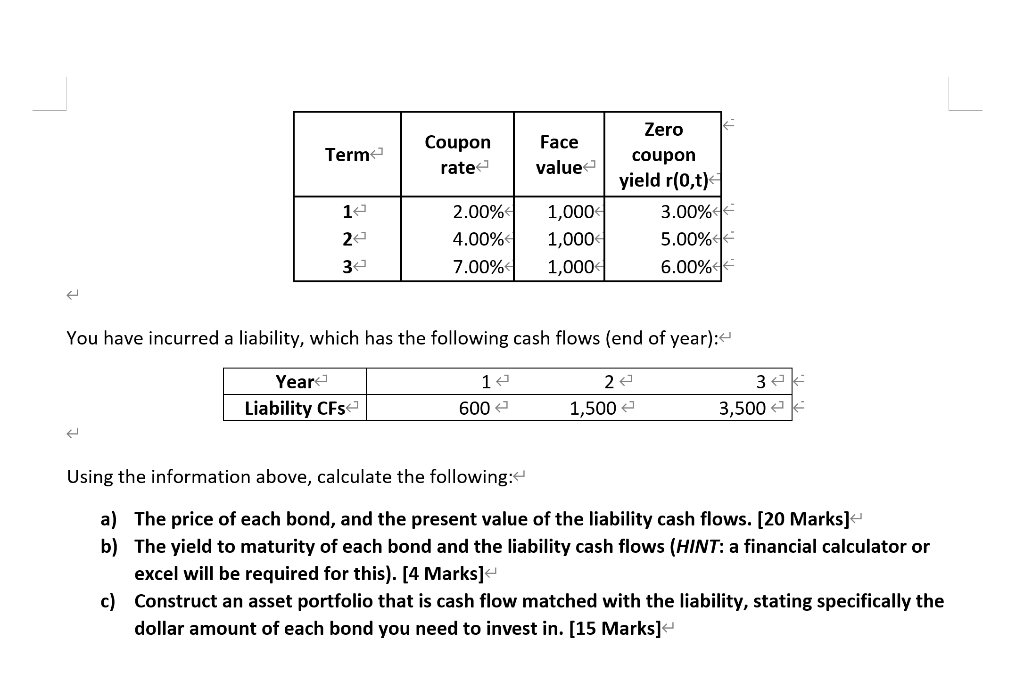

Zero Coupon Bond Value - Formula (with Calculator) A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value. Yield Curves for Zero-Coupon Bonds - Bank of Canada Yield Curves for Zero-Coupon Bonds These files contain daily yields curves for zero-coupon bonds, generated using pricing data for Government of Canada bonds and treasury bills. Each row is a single zero-coupon yield curve, with terms to maturity ranging from 0.25 years (column 1) to 30.00 years (column 120).

H.15 - Selected Interest Rates (Daily) - May 13, 2022 - Federal Reserve 13/05/2022 · The constant maturity yield values are read from the yield curve at fixed maturities, currently 1, 3, and 6 months and 1, 2, 3, 5, 7, 10, 20, and 30 years. This method provides a yield for a 10-year maturity, for example, even if no outstanding security has exactly 10 years remaining to maturity. Similarly, yields on inflation-indexed ...

Yield to maturity for zero coupon bond

Bond Yield to Maturity (YTM) Calculator - DQYDJ Yield to Maturity of Zero Coupon Bonds. A zero coupon bond is a bond which doesn't pay periodic payments, instead having only a face value (value at maturity) and a present value (current value). This makes calculating the yield to maturity of a zero coupon bond straight-forward: A zero coupon bond has a yield to maturity of 12 and a par ... 105. You have just purchased a 7-year zero-coupon bond with a yield to maturity of 11% and a par value of $1,000. What would your rate of return at the end of the year be if you sell the bond? Assume the yield to maturity on the bond is 9% at the time you sell. A. 10.00% B. 23.8% C. 13.8% D. 1.4% E. How do I Calculate Zero Coupon Bond Yield? (with picture) Zero coupon bond yield is calculated by using the present value equation and solving it for the discount rate. The resulting rate is the yield. It is both the discount rate that is revealed by the market situation and the return rate that investors expect from the bond. The zero coupon bond yield helps investors decide whether to invest in bonds.

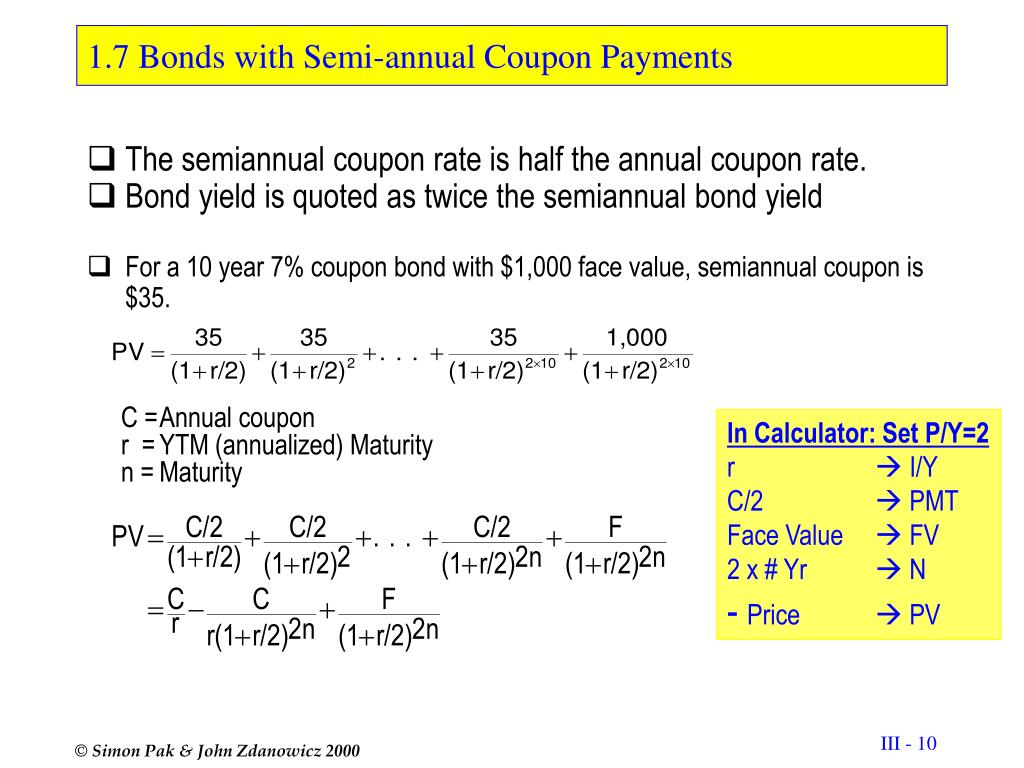

Yield to maturity for zero coupon bond. Yield to Maturity | Formula, Examples, Conclusion, Calculator 12/04/2022 · Yield to maturity (YTM) is the total expected return from a bond when it is held until maturity – including all interest, coupon payments, and premium or discount adjustments. The YTM formula is used to calculate the bond’s yield in terms of its current market price and looks at the effective yield of a bond based on compounding. Zero Coupon Bond - Investor.gov Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due. The maturity dates on zero coupon bonds are usually long-term—many don't mature for ten ... Yield to Maturity Calculator (YTM Calculator) - YTM Formula The calculation of yield to maturity is quiet complicated, here is a yield to maturity formula to estimate the yield to maturity. Yield to Maturity (YTM) = (C+(F-P)/n)/(F+P)/2, where C = Bond Coupon Rate F = Bond Par Value P = Current Bond Price n = Years to Maturity. How to Calculate Yield to Maturity Zero Coupon Bond Calculator – What is the Market Price? P: The par or face value of the zero coupon bond; r: The interest rate of the bond; t: The time to maturity of the bond; Zero Coupon Bond Pricing Example. Let's walk through an example zero coupon bond pricing calculation for the default inputs in the tool. Face value: $1000; Interest Rate: 10%; Time to Maturity: 10 Years, 0 Months ...

Zero-Coupon Bond: Formula and Excel Calculator To calculate the yield-to-maturity (YTM) on a zero-coupon bond, first divide the face value (FV) of the bond by the present value (PV). The result is then raised to the power of one divided by the number of compounding periods. Zero-Coupon Bond YTM Formula Yield-to-Maturity (YTM) = (FV / PV) ^ (1 / t) - 1 Zero-Coupon Bond Risks iShares USD Asia High Yield Bond ETF | O9P May 12, 2022 · The iShares USD Asia High Yield Bond ETF seeks to track the investment results of an index composed of USD-denominated high yield bonds issued by Asian governments and Asian-domiciled corporations. Solved 15, A zero-coupon bond has a yield to maturity of 9 ... Transcribed image text: 15, A zero-coupon bond has a yield to maturity of 9% and a par value of $1,000 if the bond matures in eight years, the bond should sell for a price of A. $422.41 B. $501.87 C. $513.16 D. $483 49 today 16. CFA Level 1: Duration & Convexity - Introduction Of course, if the yield-to-maturity increases, the price of the bond will decrease and vice versa. Secondly, if the yield-to-maturity changes a lot, the absolute value of the percentage change in the bond price will be lower if the yield-to-maturity increases, than if the yield-to-maturity decreases. This is the result of the convexity of the ...

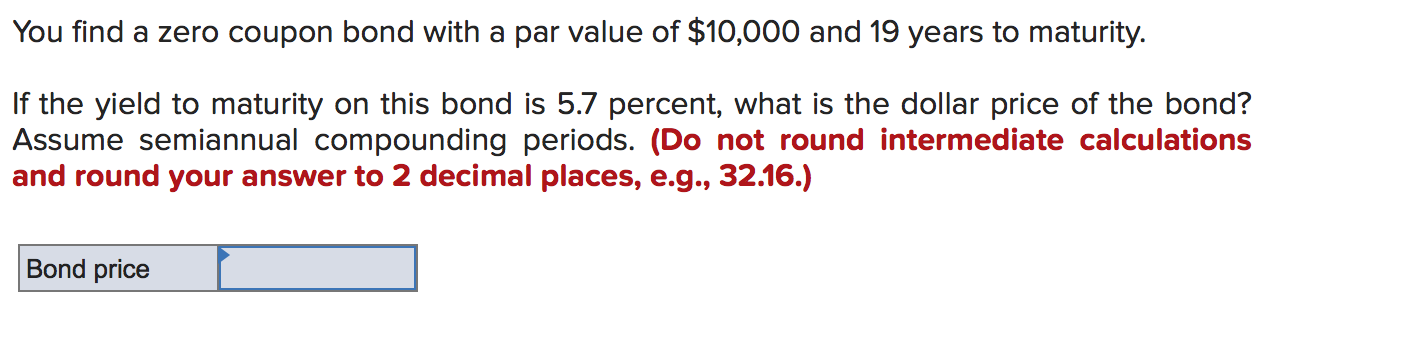

c) Calculate the Present Value of a zero-coupon bond ... Find the duration of the zero-coupon bond. an. Question: c) Calculate the Present Value of a zero-coupon bond with nominal value 1 million pounds and yield to maturity 6% pa and time to maturity equal to 10 years. Find the duration of the zero-coupon bond. an. Zero Coupon Bond Calculator - What is the Market Price ... Zero Coupon Bond Calculator Inputs. Bond Face Value/Par Value ($) - The face or par value of the bond - essentially, the value of the bond on its maturity date. Annual Interest Rate (%) - The interest rate paid on the zero coupon bond. Years to Maturity - The numbers of years until the zero coupon bond's maturity date.; Months to Maturity - The numbers of months until bond maturity (not this ... Zero Coupon Bonds India- Invest in Zero Coupon Bonds A zero coupon bond is a debt instrument wherein the issuer does not make any coupon payment but instead trades at a deep discount, rendering a profit at maturity, when the bond is redeemed for its full face value. A zero-coupon bond will usually have higher returns than a regular bond with the same maturity because of the shape of the yield curve. YIELDS TO MATURITY ON ZERO-COUPON RONDS - Bond Math Fourteen-year TIGRS are priced at $250 to yield 10.151% (s.a.). Such problems are easily solved using the time-value-of-money keys on a financial calculator or a spreadsheet program. In this chapter, I work with a 10-year zero-coupon corporate bond that is priced at 60 (percent of par value). Its yield to maturity is 5.174% (s.a.).

Japan - Zero-coupon yield bond - Japan 10-year Zero coupon Yield Curve - Yield, end of period ...

Advantages and Risks of Zero Coupon Treasury Bonds The responsiveness of bond prices to interest rate changes increases with the term to maturity and decreases with interest payments. Thus, the most responsive bond has a long time to maturity...

Zero-Coupon Bond Definition - Investopedia The maturity dates on zero-coupon bonds are usually long-term, with initial maturities of at least 10 years. These long-term maturity dates let investors plan for long-range goals, such as saving...

Zero Coupon Bond Yield: Formula, Considerations, and ... The formula for calculating the yield to maturity on a zero-coupon bond is: Yield To Maturity= (Face Value/Current Bond Price)^ (1/Years To Maturity)−1 Zero-Coupon Bond YTM Example Consider a...

Zero Coupon Bond (Definition, Formula, Examples, Calculations) Zero-Coupon Bond Value = [$1000/ (1+0.08)^10] = $463.19 Thus the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19.

Effective Yield Definition Mar 23, 2020 · Effective yield is a bond yield that assumes coupon payments are reinvested after being received. ... How to Calculate Yield to Maturity of a Zero-Coupon Bond. Fixed Income.

What is the yield to maturity of a five-year, $5,000 bond with a 4.4 % coupon rate... - HomeworkLib

Bond Yield Definition 01/01/2022 · If the original bond owner wants to sell the bond, the price can be lowered so that the coupon payments and maturity value equal a yield of 12%. In this case, that means the investor would drop ...

Zero-Coupon Inflation-Indexed Swap - Wikipedia The Zero-Coupon Inflation Swap (ZCIS) is a standard derivative product which payoff depends on the Inflation rate realized over a given period of time. The underlying asset is a single Consumer price index (CPI).. It is called Zero-Coupon because there is only one cash flow at the maturity of the swap, without any intermediate coupon.. It is called Swap because at maturity …

You find a zero coupon bond with a par value of $10,000 and 20 years to maturity. The yield to ...

Value and Yield of a Zero-Coupon Bond | Formula & Example = $5,317 This gain of $5,317 is made up of the unwinding of discount (the increase in present value as it nears maturity) plus capital gain portion that results from positive movement in market yield on the bond. The value of zero-coupon bond will continue to increase till it reach $100,000 at the time of its maturity.

Zero Coupon Bond Calculator 【Yield & Formula】 - Nerd Counter For instance, the maturity period of a zero-coupon bond is 10-years, its par value is $1000, the interest rate is 5.00%. When we are calculating the bond price in Excel, suppose we use the B column of the excel sheet for entering the values where B2 is the face value, B3 is the maturity time period, B4 is the interest rate.

Zero-Coupon Bond - Definition, How It Works, Formula John is looking to purchase a zero-coupon bond with a face value of $1,000 and 5 years to maturity. The interest rate on the bond is 5% compounded semi-annually. What price will John pay for the bond today? Price of bond = $1,000 / (1+0.05/2) 5*2 = $781.20 The price that John will pay for the bond today is $781.20.

Zero Coupon Bond Yield Calculator - YTM of a discount bond Zero Coupon Bond Yield Calculator. A Zero Coupon Bond or a Deep Discount Bond is a bond that does not pay periodic coupon or interest. These bonds are issued at a discount to their face value and therefore the difference between the face value of the bond and its issue price represents the interest yield of the bond.

Yield To Maturity Calculation Method - CALKUO The constant yield method calculates the value of a zero-coupon bond at a given point of time before its maturity. The calculation is altered by estimating the time when the bond can be. A higher yield to maturity will have a lower present value or purchase price of a bond. Yield to Maturity.

Zero coupon bond yield to maturity calculator 778066-Coupon bond yield to maturity calculator

Yield to Maturity (YTM) - Overview, Formula, and Importance The coupon rate Coupon Rate A coupon rate is the amount of annual interest income paid to a bondholder, based on the face value of the bond. for the bond is 15% and the bond will reach maturity in 7 years. The formula for determining approximate YTM would look like below: The approximated YTM on the bond is 18.53%. Importance of Yield to Maturity

Zero Coupon Bond Value Calculator: Calculate Price, Yield ... Calculating Yield to Maturity on a Zero-coupon Bond YTM = (M/P) 1/n - 1 variable definitions: YTM = yield to maturity, as a decimal (multiply it by 100 to convert it to percent) M = maturity value P = price n = years until maturity Let's say a zero coupon bond is issued for $500 and will pay $1,000 at maturity in 30 years.

Zero Coupon Bond Yield - Formula (with Calculator) The formula for calculating the effective yield on a discount bond, or zero coupon bond, can be found by rearranging the present value of a zero coupon bond formula: This formula can be written as This formula will then become By subtracting 1 from the both sides, the result would be the formula shown at the top of the page. Return to Top

How to Calculate a Zero Coupon Bond Price | Double Entry ... As the face value paid at the maturity date remains the same (1,000), the price investors are willing to pay to buy the zero coupon bonds must fall from 816 to 751, in order from the return to increase from 7% to 10%. Bond Price and Term to Maturity The longer the term the zero coupon bond is issued for the lower the bond price will be.

How to Construct a Zero Coupon Yield Curve in Excel? Yield to Maturity: 3%: 3.50%: 4.50%: 6%: ... Hence, the spot rate for the 6-month zero-coupon bond Zero-coupon Bond In contrast to a typical coupon-bearing bond, a zero-coupon bond (also known as a Pure Discount Bond or Accrual Bond) is a bond that is issued at a discount to its par value and does not pay periodic interest. In other words, the ...

:max_bytes(150000):strip_icc()/dotdash_INV_final_Discount_Yield_Jan_2021-01-fc704294a32348a7bc00e0fc7652b88e.jpg)

Post a Comment for "43 yield to maturity for zero coupon bond"